主持人:彭作祥(教授、博导,西南大学)

|

主讲人:刘佳骏(9:00-9:30,西交利物浦大学数学科学系精算科学讲师,博士生导师,利物浦大学学士,利物浦大学数学科学系博士学位(双学位:精算学和统计学)博士.主要研究保险和金融风险的相互作用,极值相依性,以及保险、金融和风险管理中的重尾分布.其研究成果主要发表在Insurance: Mathematics and Economics, Stochastic Models, and Journal of Industrial and Management Optimization等杂志上)

题目:Asymptotics for systemic risk with dependent heavy-tailed losses

摘要:Systemic risk is considered as the risk of collapse of an entire financial system, which has played a significant role in explaining the recent financial turmoils from the insurance and financial industries. Although there exist a very large number of systemic risk measures in the literature on the Systemic risk (SR), the more simple SR definition from Acharya et al. (2012) is chosen to be discussed. We consider the tail behavior of the SR for portfolio losses. We generalize the model to allow for heavy - tailed distribution of risk factors, which are equipped with a wide type of dependence structure. For various important cases, asymptotic formulas for the SR are derived. This risk model provides an ideal frame work for modeling both heavy tails and dependence. As an extension, simulation experiments are conducted, comparing the asymptotic formulas with the traditional empirical estimators, which show that our approach is superior to an empirical approach.

|

主讲人:张志民(9:30-10:00,重庆大学数学与统计学院教授,博导,香港大学、墨尔本大学访问学者.主要研究兴趣为风险管理与精算学,现为中国工业与应用数学学会金融数学、金融工程、精算与保险青年专业委员会副主任.主持国家自然基金面上项目2项,青年基金1项,教育部博士点基金和重庆市基金各一项.发表SCI、SSCI论文40余篇,其中多篇论文发表在精算学顶级杂志Insurance: Mathematics and Economics, Scandinavian Actuarial Journal, ASTIN Bulletin上)

题目:Optimal loss-carry-forward taxation for Levy risk processes stopped at general draw-down time

摘要:Motivated by Kyprianou and Zhou (2009), Wang and Hu (2012) and Li et al. (2017), we consider in this paper the problem of maximizing the expected accumulated discounted tax payments of an insurance company, whose reserve process (before taxes are deducted) evolves as a spectrally negative Levy process with the usual exclusion of negative subordinator or deterministic drift. Tax payments are collected according to the very general loss-carry-forward tax system introduced in Kyprianou and Zhou (2009). To achieve a balance between taxation optimization and solvency, we consider an interesting modified objective function by considering the expected accumulated discounted tax payments of the company until the general draw-down time, instead of until the classical ruin time. The optimal tax return function together with the optimal tax strategy is derived, and some numerical examples are also provided.

|

主讲人:白龙(10:00-10:30,西交利物浦大学讲师,瑞士洛桑大学精算学博士学位(2018),南开大学概率与统计专业硕士学位(2015)。主要从事随机过程极值理论以及应用等方面研究,于博士期间发表完成十余篇概率及保险精算相关领域文章于国际知名杂志,包括Scandinavian Actuarial Journal, Journal of Theoretical Probability, Science China Mathematics以及Methodology and Computing in Applied Probability等)

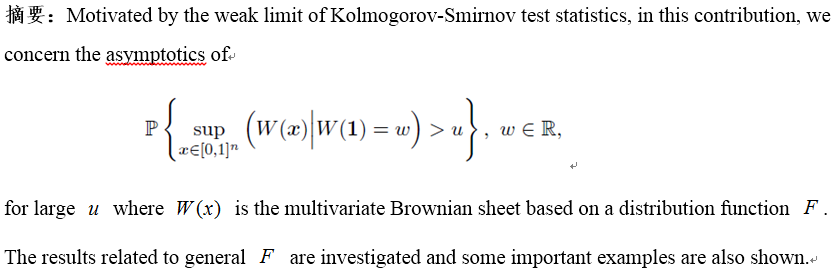

题目:Approximation of Kolmogorov-Smirnov test statistics

|

10:30-11:00,咖啡交流时间

|

主持人:张志民(教授、博导,重庆大学)

|

主讲人:喻开志(11:00-11:30,西南财经大学数量经济学教授、博导,数量经济研究所所长,中国数量经济学会常务理事,四川省学术和技术带头人后备人选。曾访问美国密歇根大学,台湾淡江大学,为《经济研究》、《经济学(季刊)》、《数理统计与管理》、《财经科学》、《统计与信息论坛》、《Mathematical Reviews》等匿名审稿人。主要从事实证金融,经济计量及统计建模,统计理论和方法等科学研究工作。特别擅长金融时间序列、应用微观计量、实证金融、消费经济、风险计量与管理、重大事件及经济结构变化的检测及预报等方面的研究工作。先后主持国家自然基金青年项目1项、国家社科基金1项、教育部人文社科基金1项、国家统计局课题1项、国务院第三次全国经济普查课题1项、四川省社科课题2项、四川省科技厅1项,四川省统计局课题2项、校级课题6项,参与多项国家自然基金、国家社科基金、四川省社科基金课题;先后在《经济研究》、《统计研究》、《国际金融研究》、《数理统计与管理》、《经济学(季刊)》、《消费经济》、《经济评论》、《财经科学》、《Applied Stochastic Models in Business and Industry》、《Mathematical Problems in Engineering》、《Journal of Applied Mathematics》等国内权威核心期刊和SCI期刊上发表论文30余篇,其中2篇论文被人大报刊复印资料全文转载,2篇论文分别获得四川省第十六次、第十七次社会科学优秀成果奖二等奖)

题目:基于HCW思想的分位数处理效应估计研究

摘要:为了在没有协变量和工具变量的情况下估计一项政策对某地区中的不同群体在目标变量上产生的影响并对估计量进行方差缩减和分解,本文首先将QTE与HCW结合得到政策影响估计量,然后利用交叉验证以及扩展样本空间来缩减估计量的方差,最后通过计算不同群体受到的平均影响来实现估计量的分解。研究发现:得到的政策影响估计量具有一致性和渐进正态性;交叉验证和扩展样本空间缩减了估计量的方差;分解的共有影响和特有影响是一致的并在一定条件下分别仅由政策和群体自身特性造成。研究创新点包括:首次将QTE与HCW结合以摆脱估计政策影响时对协变量和工具变量的依赖;通过提取相似样本的方式扩展了样本空间;实现了政策影响估计量的分解。研究成果为政府等机构细致化地评价政策所产生影响提供了有力的工具。

|

主讲人:彭小帆(11:30-12:00,电子科技大学数学科学学院副教授,2007年获得电子科技大学学士学位, 2013年获得南开大学博士学位。曾访问洛桑大学和香港大学,研究兴趣包括随机过程及其在破产理论中的应用.论文主要发表于国际知名杂志“Applied Mathematics & Optimization”, “Statistics and Probability Letters”, “Methodology and Computing in Applied Probability”等)

题目:Approximation of sojourn time of Gaussian processes

摘要:We investigate the tail asymptotic behavior of the sojourn time for a large class of centered Gaussian processes X, in both continuous- and discrete-time framework. All results obtained here are new for the discrete-time case. In the continuous-time case, we complement the investigations of Berman (Commun. Pure Appl. Math. 38(5):519–528, 1985 and Probab. Theory Relat. Fields 20(1):113–124, 1987) for non-stationary X. A by-product of our investigation is a new representation of Pickands constant which is important for Monte-Carlo simulations and yields a sharp lower bound for Pickands constant. This is a joint work with Prof. Krzysztof Debicki and Prof. Zbigniew Michna.

|

午休

|

主持人:凌成秀(副教授、博士,西南大学)

|

主讲人:李曼曼(14:30-15:00,重庆大学数学与统计学院副教授,硕士生导师,兼任中国精算师水平测试重庆大学测试中心秘书.美国韦恩州立大学应用数学系访问学者,中南大学理学博士,重庆大学应用经济学博士后.自2010年以来一直从事保险精算理论与应用统计方面的教学科研工作,合编出版《概率论与数理统计》教材1部,目前主持/主研教育部人文社科青年基金项目各1项,主研国家自然科学基金2项,公开发表学术论文10多篇,主要研究成果集中在保险精算模型理论、最优保险分红理论研究及农业风险评估等方面)

题目:Optimal threshold strategies with capital injections in a spectrally negative Levy risk model

摘要:This paper focuses on optimal threshold strategies for a spectrally negative Levy (SNL) risk process with capital injections and proportional transaction costs. Restricted to solvency constraint, our model requires the shareholders of dividends prevent ruin by injecting capitals. Value function of the firm is assumed to be an expected discounted total [dividends less discounted capital injection]. Under such a setup, we derive certain key identities in connection with value function of the firm of a maximum dividend rate. Under restricted dividend rates and capital injection, we give analytical description of the maximum value function of the firm and the optimal threshold strategy explicitly.

|

主讲人:杨丹(15:00-15:30,西南大学教授,博士,主要从事农业经济学、发展经济学、应用计量经济学等领域的研究。法国图卢兹第一大学图卢兹经济学院(TSE)博士后,美国南卡莱罗纳大学(USC)摩尔商学院访问学者、浙江大学中国农村发展研究院(CARD)高级访问学者、国际食品政策研究所(IFPRI,北京)访问学者。亚洲开发银行(ADB)咨询专家、重庆市立法咨询委员、中国农业技术经济学会理事。曾获重庆市优秀博士论文奖、CAER-IFPRI国际学术会议最佳会议论文奖;先后主持亚洲开发银行(ADB)国际项目2项、国家社科基金项目2项,以及国家社科重大项目子课题、教育部人文社科项目、重庆市教育规划重点项目等十余项学术研究项目;曾在《Economic Modelling》、《Agricultural Economics》、《Journal of Economic Surveys》等SSCI、SCI期刊和《管理世界》、《经济学动态》、《数量经济与技术经济研究》、《经济科学》、《农业技术经济》、《中国农村观察》等CSSCI期刊上公开发表多篇学术论文。研究成果多次被引用和转载)

题目:中国农地确权的减贫效应研究

摘要:贫困人口土地产权明晰被视为减轻贫困的中心策略,而农地确权正是国家明晰土地产权的重要举措。本文首先构建农地确权减贫效应的理论分析框架,然后基于中国劳动力动态调查(CLDS)2014年数据使用内生转换模型(Endogenous Switching Regression,ESR)分析农地确权对家庭人均农业纯收入的影响,用内生转换Probit模型(Endogenous Switching Probit,ESP)分析农地确权对贫困的影响。研究结果表明:(1)农地确权能显著提高家庭人均农业纯收入,且总体上农地确权组相较于未确权组家庭农业人均纯收入平均提高4.58%;(2)农地确权具有显著的减贫效应,且在反事实情况下,对于非确权组,若确权了,则其贫困发生的概率将降低8.35%;(3)家庭主事者的受教育水平对农地确权的增收减贫效应具有调节效应;(4)农业经营投入对农地确权的增收减贫效应具有中介效应。本文的研究为评估与优化中国正在实施的三权分置政策、精准扶贫工作以及乡村振兴战略的提供了有力的证据与有益的参考。

|

15:30-15:45,咖啡交流时间

|

主持人:杨丹(教授、博士,西南大学)

|

主讲人:翁志超(15:45-16:15,福州大学副教授、洛桑大学保险精算博士,主研极值理论及其风险管理模型渐近分析)

题目:Joint limiting distribution of maxima and minima of bivariate Gaussian triangular arrays

摘要:It is known that the normalized maxima of a sequence of independent and identically distributed bivariate normal random vectors with correlation coefficient rho ∈ (−1,1) is asymptotically independent, which may seriously underestimate extreme probabilities in practice. By letting rho depend on the sample size and go to one with certain rate, Husler and Reiss (1989) showed that the normalized maxima can become asymptotically dependent. In this paper, we derive the joint limiting distribution of maxima and minima of stationary bivariate Gaussian arrays under the Husler-Reiss condition. It turns out that maxima and minima are asymptotically independence.

|

主讲人:凌成秀(16:15-16:45,西南大学副教授、硕导、洛桑大学保险精算博士、访问洛桑大学,洪堡大学及弗罗茨瓦夫大学,主研风险管理极值模型、极值统计、随机过程极值渐近分析,发表论文17余篇于Insurance: Mathematics and Economics, Extremes等国际学术杂志,主持国家自然科学基金青年项目一项,为Statistics and ProbabilityLetters, Journal of Business and Economics等杂志匿名审稿人)

题目:Asymptotics of multivariate conditional risk measures of Gaussian risks

摘要:This paper investigates accurate approximations of marginal moment excess, marginal conditional tail moment and marginal moment shortfall for multivariate Gaussian system risks. Based on the dimension reduction property via the quadratic programming problem, the super-exponential and polynomial convergence speeds are specified. Two interesting questions involved in risk management are well addressed, namely the minimal

additional risk capital to avoid infinite risk contagion and a sufficient and necessary condition to alternate the convergence speeds. Numerical study and several examples are given to illustrate the efficiency of our findings. Due to the flexible moment order, additional applications may involve in risk management, including tail mean-variance portfolio and multivariate conditional risk measures of tail covariance, tail skewness with dependence and extremal risk contagion under consideration.

|